Remember the marshmallow test? Thanks to a suggestion from our friend Zach Speert, we’re comparing the similarities of the marshmallow test with the benefits of investing.

We are currently in the 5th month of a global pandemic and its economic, social, and political repercussions. It’s safe to say that we’re all feeling a bit of anxiety. Let’s briefly recap what has been happening April through June 2020.

Did you know that when you purchase a stock or an equity, that means you own a share of the company. And as a part owner of a publicly traded company, you have the right to influence its policies (even if you only own one share!). This is where shareholder advocacy comes in.

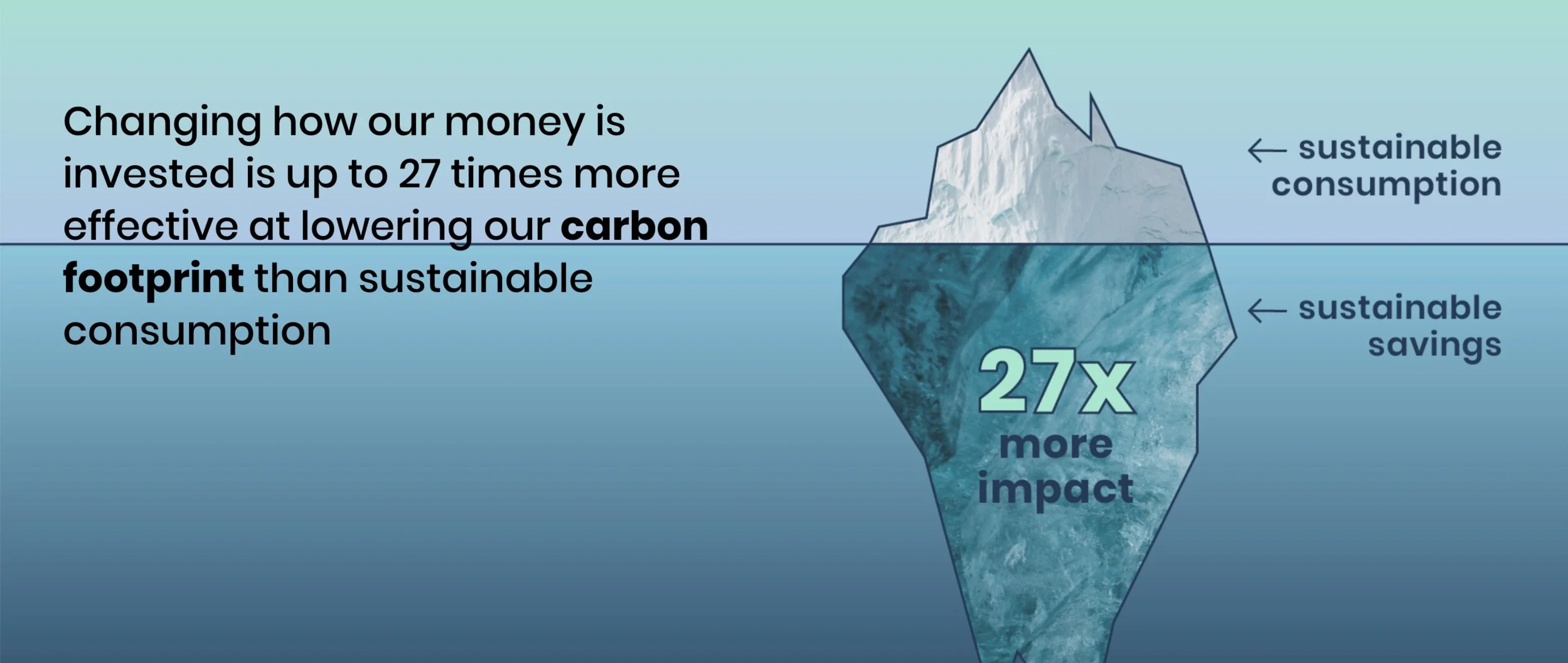

Changing how your money is invested is up to 27 times more effective at lowering your carbon footprint than buying sustainably. Last week we talked about voting with your dollars by buying from companies that align with your values. This week we’re going to get into another way of voting with your dollars, your invested and saved dollars in particular.

One of the questions we’ve been getting a lot lately is “where can we find good companies across industries to support, that are fair to their employees, promote BIPOC and other minorities, and care about the environment for starters?”

We recently watched Ava DuVernay’s 13th on Netflix, which we’d highly recommend if you haven’t already seen it. 13th is a documentary that traces the history and link between slavery and today’s mass incarceration. Here’s what we found when we looked into whether or not we are in any way supporting the prison system in the US.

Investing in companies that we believe in, that share our vision for the future is more important now than ever. We want to help build a better future by directing our money to companies that are taking action and committing to our shared vision for the future. Companies that want to do and be better.

As I researched racial wealth inequality this past week, I got angrier and angrier. How could the oppression of and violence against Black Americans be such a salient theme throughout our history, yet so conveniently forgotten or rather, written over?

The murders of Ahmaud Arbery, Breonna Taylor, George Floyd, and countless others have reminded us again and again that our American history of hundreds of years of oppression and racism still exist today. This moment in time feels like a turning point for our country and I dearly hope that it is.

Let’s take the next step in reflecting on our relationship with money and think about how we want to spend our hard-earned money. What feels good to me is supporting companies and causes I care about.

Shoutout to our go-getter reader Caleb for asking this thoughtful question that many others are probably also wondering about. Can passive index investing work when trying to be socially responsible or does an investor need to find an actively managed fund to make any real impact?

We’re starting this new thing! Ask us your money questions and we’ll answer them.

At first when I sat down to make this list, there must have been 20 podcasts on it. I painstakingly whittled the list down to 10. If you’re wondering what the other 10 were, I’d be more than happy to share them with you. Time to get to listening and learning! Here’s a list of our absolute faves.

April 22, 2020 marks the 50th anniversary of Earth Day. Here’s what we’re doing throughout the week to show our appreciation for and celebrate our planet Earth.

In the first three months of 2020, the world changed before our eyes. In January, our major global concerns were the Australian wildfires, the trade war with China, and the Presidential impeachment. Now, the economy and markets are driven by reactions to the spread of the coronavirus as well as government responses.

Nobody can predict the market. However there are experts who have been in the industry for many years, who invest and look at the markets for a living. And no we aren’t talking about ourselves. We’re not famous enough to be quoted...yet.

Check out our conversation with Jaimie Pruden and Meghan Offtermatt at How To Save The World Podcast and let us know what you think. Be sure to rate, subscribe, and follow How To Save The World as Jaimie and Meghan share their own sustainability journeys and learn from other likeminded advocates.

You can listen to the full podcast here.

COVID has been tough on the markets these past few weeks, but the silver lining is that ESG (environmental, social, and governance) funds “have been outperforming convention funds this month.”

With all of us being hermits these days, we thought it would be the perfect time to share some of our favorite books. Here are our favorites when it comes to personal finance and investing. Here’s to emerging from social distancing as a financially savvier you!

Remember last week when we said we weren't worried about the market? Well that part is still true, but all the negative news surrounding coronavirus is starting to get to us. We want to channel this anxiety into something more productive. More on mental wellbeing at the bottom, but first things first, what to do right now to be proactive with your money.

We wanted to check in with all the uncertainty in the air. First and foremost, we wanted you to know that we’re all for taking precautionary measures, but overall we’re not worried.

Give yourself a high-five! With a high bank account balance, you’ve already established an emergency fund. This also means that you are a champ at budgeting, saving, and living within your means. So what do you do with the money that’s in excess of your emergency fund? The simple answer, help your future self!

Psssst you may not know this, but if you invest your money is most likely going to a long list of companies that include gun-makers. All these shootings we keep seeing in the news? You’re probably not helping.

It’s 2020! A new decade. A more efficient, productive, financially savvy, fit, healthy, self-care practicing you is here! Or maybe that’s a bit too ambitious. In the meantime, here’s a little something to help you get started on being financially savvy.

The fourth quarter of 2019 had its fair share of political drama. We witnessed a historic impeachment and the start of the 2020 election cycle. What consequences, if any, do politics have on the direction of the stock market and ultimately your portfolio?

It’s that time of the year again, when people look forward to the new year, a new beginning, a clean fresh start.

As 2019 comes to a close, we wanted to take a moment to lovingly look back on our year together and reflect upon everything we're grateful for this year.

We want to empower you and all women to embrace and take control of your finances. There are so many cards in the deck stacked against women.

We discuss what exactly constitutes impact investing, how their approach is different from other investment groups, and why it’s one of the best ways to use money as a means for change. We also discuss why people, especially women, should invest and why it’s essential to be your own advocate in life. This conversation sheds light on the fact that when utilized correctly, financial literacy and conscious investments are stepping stones to a better future.

There are many different approaches to investing. At Good Capital, we live by a goal-based approach. Goal-based investing means putting your money to work in order to accomplish something specific in your life. Your goal may be to buy a house or start a business. Practicing a goal-based approach to investing will increase the probability of a successful outcome while simultaneously decreasing your financial stress.