As we approach the summer months, there has been a barrage of negative economic news: persistent inflation, high oil prices, negative business and consumer sentiment. These macroeconomic issues have pushed markets into negative territory for 2022.

When we started Good Capital in 2018, we built our practice around the idea that achieving financial goals was possible alongside creating positive societal and environmental impact. Fast forward to 2022, and it’s incredible to see how far we’ve come, how much of an impact we’ve already had, and how much more work needs to be done. Now to present to you all the change our clients aka impact investors have created over the past year.

This week, we’re bringing intention into investing. Whether or not you realize it, the money choices you make can have a profound impact on your life as well as on the world around you. To be intentional about investing, we want to think about two things - why we’re investing and what we’re investing in.

This week, we're delving deeper into how we can bring intention into our everyday lives and how we approach saving.

Gideon here, bringing things back to the end of 2021 for a minute. Here's what happened and here's what we have looking forward into 2022.

So now that it’s 2022, I’m trying out something new. Rather than make a new year’s resolution, I decided to focus on one word to keep coming back to throughout the year. I was deciding between several different words. Savor, dream, patience, and build were all up there, but I’ve settled on the word intention.

If you have to buy, buy sustainable, but let’s not let it distract us from the bigger picture. Giving to organizations and investing in companies that are creating change will make way more of an impact than choosing to buy a sustainably made product.

We’ve been practicing giving intentionally over the past few years and wanted to share some things that have worked for us and that you may find helpful.

We’re prepping for end of year things and thought it might be helpful to share some financial planning items you may want to think about as well.

This is a question we get fairly frequently and our answer is always yes (assuming you have an emergency fund set aside, your debt is paid off, etc.), so hear us out on this one.

Wondering why we are so adamant about getting you into investing asap? It’s because of the power of investing early and compound interest. Here’s a hypothetical example of two people who started investing at different times in life and where their accounts ended up.

Check in on all of your accounts. This might seem obvious, but many of us are not in the habit of looking. It is important to know how much you have, in what type of account, and what that money is doing. Here are 6 types of accounts you should have and what to look for.

Happy Fall! Here are some of the economic highlights from the summer months of 2021. The delta variant, political gridlock, and inflation were the three key themes in the third quarter of 2021. Let’s break it down.

Would you consider yourself to be financially healthy? Financial wellness is a consistent practice, much like other areas of wellness. You can’t just do it once and be financially well, just like you can’t just workout once and then be fit forever (though I do wish it were that easy!). If we regularly accomplish these small steps, they’ll add up to big changes in the long run.

Here are the 7 steps to help you achieve financial wellness.

Thinking about aligning your money with your values? Just like with other aspects of your life, you may be thinking about how you can make sure your money is in alignment with who you are and what you stand for.

CDFIs can be a great way to incorporate environmental, social, and governance factors into your investing. They also offer an option for more locally focused impact.

I wanted to share this because I know even for me, as someone working in financial services, I was overwhelmed by all the different types of financial advisors, planners, money managers, and coaches. Here’s a comprehensive breakdown of the world of financial advising for individuals and families, but keep in mind that there are tons of nuances.

Whether you are looking for a new financial advisor or are approaching your current financial advisor, here are some questions to help them help you align your money with your values and support the positive impact that you want to have.

Where you spend your money directly translates to whom or which businesses you’re supporting. What feels good to me is supporting companies and causes I care about.

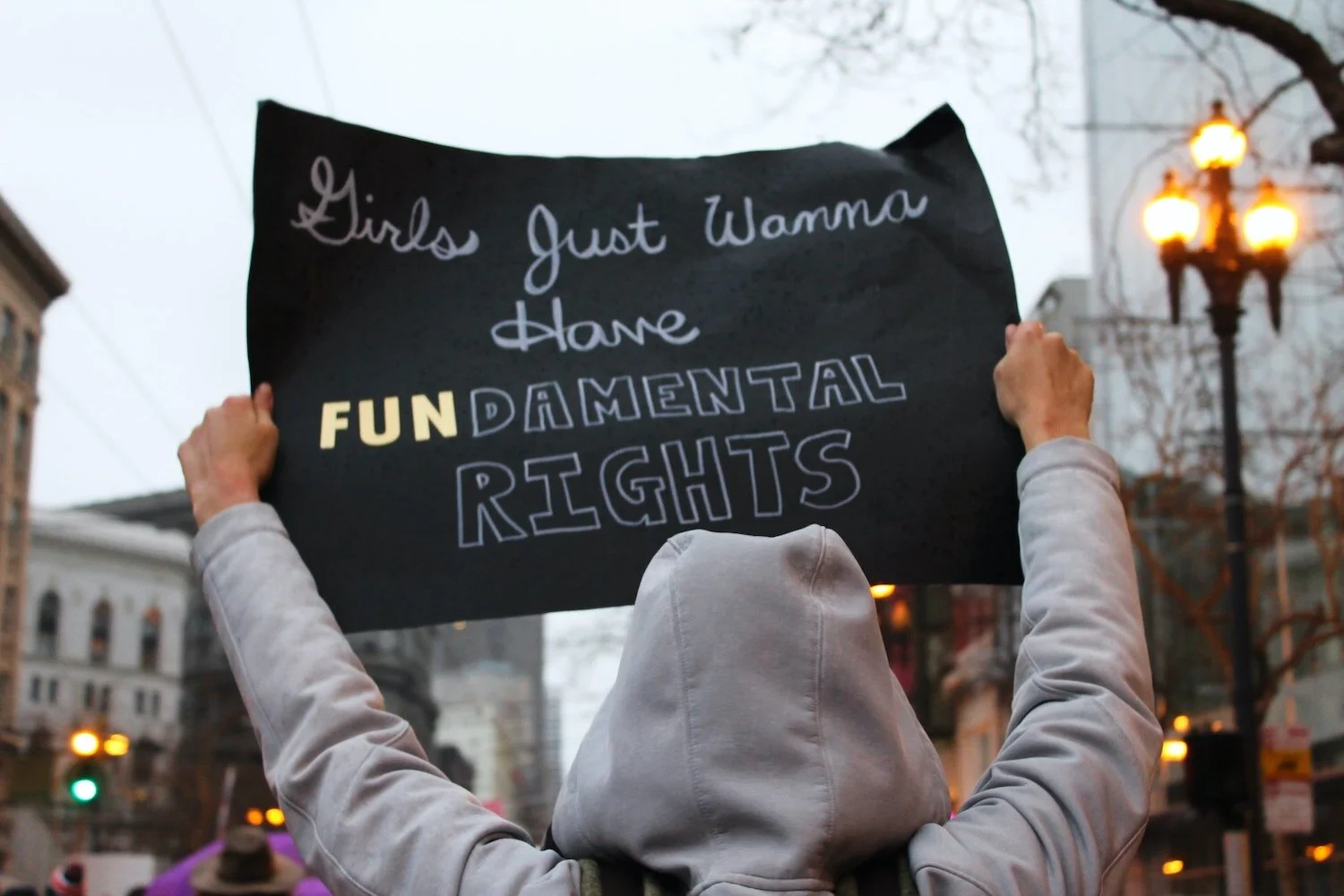

Earlier this year, we talked about how to invest in gender equity and how this pandemic has had a disproportionately negative effect on women. With Texas’ anti-abortion law SB8 taking effect last week, it’s a good time to revisit gender equity and talk about the economics behind abortion access.

Here we are 2 months into quarantine, and I find myself re-examining my life, trying to figure out how we can make this new reality as meaningful and joyful as possible. I’m going to get existential here, but what’s the point of everything if it’s not meaningful or making you happy?

In our intro to achieving financial wellness, we suggest getting started with three things to reflect upon.

How do you feel about your current financial situation?

What are your life goals?

How does money fit into these goals?

Q2 of 2021 had its fair share of positive virus and economic news which resulted in all-time market highs. Here’s what you need to know.

Springtime is here and YOU can spring clean your finances. One of the easiest ways you can simplify your finances (and headaches) is to combine old 401ks from previous employers. Think of it like a transformer. One is great, but if you combine multiple together, that makes for a super powerful entity!

Having an emergency fund is a crucial part of your overall financial health. Let’s start with the basics, what is an emergency fund?

Welcome back to our blog series on how to be financially healthy! Now that you have a good handle on your expenses overall, let’s dive in a little deeper into one potentially big expense, DEBT. This may include student loans, mortgages, auto loans, and credit card debt aka consumer debt. Read on for 6 steps you can take to manage your debt.

Do you feel financially healthy? Wondering what that even means? Learn about how to get started in leading a financially healthy life.

Let’s play word association. When you think about money, what’s the first word that comes to your mind?

In the past, we’ve shared our approach to sustainable investing, how we help our clients create change using their investments, and our impact as a firm. I wanted to take a moment to share what else we’re doing behind the scenes to ensure that your wealth is working to help create the future we all want to live in.

As sustainability efforts and environmental consciousness grows, greenwashing (and the social justice equivalent) follows. Here’s what it is and how you can spot it.