As we approach the summer months, there has been a barrage of negative economic news: persistent inflation, high oil prices, negative business and consumer sentiment. These macroeconomic issues have pushed markets into negative territory for 2022.

Good Capital 2021 Impact Report

When we started Good Capital in 2018, we built our practice around the idea that achieving financial goals was possible alongside creating positive societal and environmental impact. Fast forward to 2022, and it’s incredible to see how far we’ve come, how much of an impact we’ve already had, and how much more work needs to be done. Now to present to you all the change our clients aka impact investors have created over the past year.

Investing with intention

This week, we’re bringing intention into investing. Whether or not you realize it, the money choices you make can have a profound impact on your life as well as on the world around you. To be intentional about investing, we want to think about two things - why we’re investing and what we’re investing in.

How to save and spend with intention

A look back at Q4 2021

Happy new year!

So now that it’s 2022, I’m trying out something new. Rather than make a new year’s resolution, I decided to focus on one word to keep coming back to throughout the year. I was deciding between several different words. Savor, dream, patience, and build were all up there, but I’ve settled on the word intention.

Is conscious consumerism a lie?

3 tips to upgrade your giving

5 year end money tips

Is now a good time to invest?

How does compound interest work?

6 common financial accounts you should have and what to look for

Q3 2021 Lookback

Achieving financial wellness

Would you consider yourself to be financially healthy? Financial wellness is a consistent practice, much like other areas of wellness. You can’t just do it once and be financially well, just like you can’t just workout once and then be fit forever (though I do wish it were that easy!). If we regularly accomplish these small steps, they’ll add up to big changes in the long run.

Here are the 7 steps to help you achieve financial wellness.

4 ways to align your money with your values

What is a CDFI?

What are all the different types of financial advisors?

I wanted to share this because I know even for me, as someone working in financial services, I was overwhelmed by all the different types of financial advisors, planners, money managers, and coaches. Here’s a comprehensive breakdown of the world of financial advising for individuals and families, but keep in mind that there are tons of nuances.

How to talk to a financial advisor about sustainable investing

Is your spending aligned with your values?

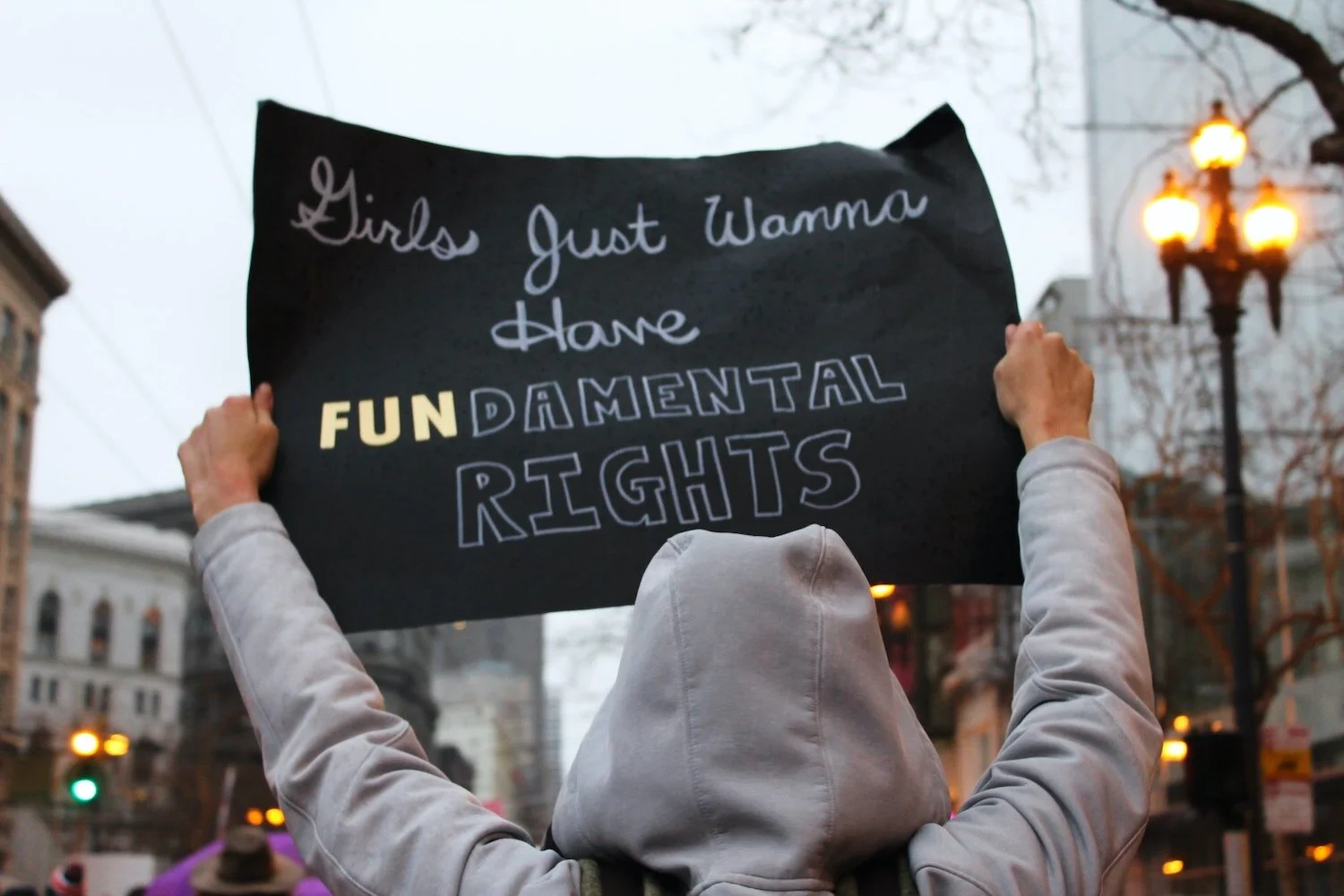

The economics of abortion access

Earlier this year, we talked about how to invest in gender equity and how this pandemic has had a disproportionately negative effect on women. With Texas’ anti-abortion law SB8 taking effect last week, it’s a good time to revisit gender equity and talk about the economics behind abortion access.